TECHNICAL ANALYSIS

Making money involves a fair bit of homework in today’s era. An investor or an active trader or any market participant should equip himself/herself with some advanced tools to get the maximum benefit out of the system.

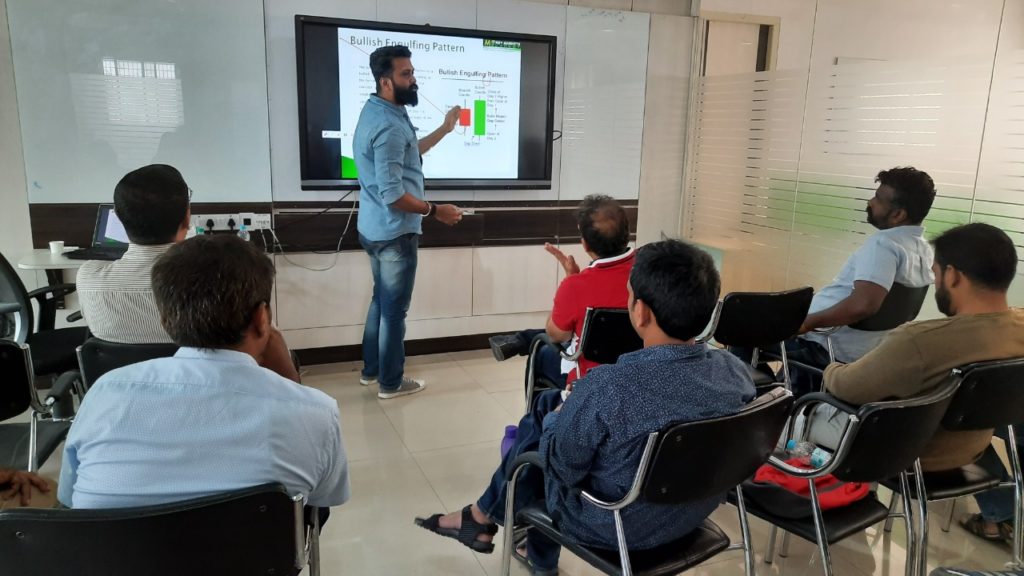

Technical and option trading is a unique course designed to keep in mind the need to provide practical knowledge to people related to the market who would like to capitalize on the emerging opportunities in the domain of options trading with the help of technical analysis to manage their portfolio and enhance their returns.

The principal objective behind this course is to bridge the gap between the participants and the opportunities available in the marketplace in different times. The strength of the course is its “Execution based learning” than theoretical knowledge only.

Technical Analysis Course:

Market Cycles

Behavioural finance

Position sizing

Moneymanagement

Intraday, Swing , Long term

Risk-Reward ratio, Stop-Loss, Re-Entry Points

Trend lines

Types of Charts- Line, Bar , Japanese Candle Sticks , Heiken Ashi

Candle Stick Patterns

Trends- Upside, Sideways and Downside

Support and Resistance

Chart Formation

- a) Trend Reversal Formation

- Head and Shoulder

- Double Top and Double Bottom

- Triple Top and Triple Bottom

. Rounded Tops and Rounded Bottoms (Saucers)

- b) Trend Continuation Formation

- Flags

- Pennant

- Wedges

- Triangles

Oscillators – RSI,STOCHASTIC, MOVING AVERAGE,BULLISH DIVERGENCE, BEARISH DIVERGENCE

Bollinger Band

Discipline and Risk Management

COURSE HIGHLIGHTS

Training in live trading setups with real time market tracking and research

Learning from expert market participants

Detailed discussion and exercise on Technicals Analysis

Scientifically designed course by the market experienced knowledge team

Real Time Market monitoring at a week long workshop with main Faculty

ADDED ADVANTAGE

Spreadsheet – To conduct scenario analysis of different portfolios under various scenarios.

Software – Learn to use easy and free software with real time feed.

Library – Vast resources of research papers and books to help you understand.

High end software Metastock,Falcon, Bloomberg, In-house notes on Technical Analysis

Screen Management – How to use your derivative screen, technical charts, spreadsheet and software

WHO SHOULD ATTEND

Freshers who would like to build a rewarding career

Brokers and Sub brokers who wish to enhance their product portfolio in low cost

Portfolio managers desiring to add alpha to their portfolio with little leverage

Day traders and Arbitrageurs who wants to maximize their returns with little extra effort

Freshers who wish to create his/her own niche in the market

Practicing chartered accountants with a keen interest in the markets.

Branch managers and Relationship managers