DOW Theory

Introduction

Dow Theory is named after Charles H Dow, who is considered as the father of Technical Analysis. Dow Theory is very basic and more than 100 years old but still remains the foundation of Technical Analysis.

Charles H Dow(1851-1902) ,however neither wrote a book nor published his complete theory on the market, but several followers and associates have published work based on his theory from 255 Wall Street Journal editorials written by him. These editorials reflected his belief on stock market behavior. Some of the most important contributors to Dow Theory are

a. Samuel A. Nelson- He is the first person to use the term Dow Theory and he selected fifteen articles by Charles Dow for his book The ABC of Stock Speculation.

b. William P. Hamilton-He wrote a book titled The Stock Market Barometer which is a comprehensive summary of the findings that Charles H Dow and Samuel A. Nelson have gathered.

c. Robert Rhea- He wrote a book titled The Dow Theory.

d. George E Schaefer- He wrote a book titled How I Helped More than 10000 Investors to profit in Stocks.

e. Richard Russell- He wrote a book titled The Dow Theory Today.

Principles of Dow Theory

The Dow Theory is made up of six basic principles. Let’s understand the principles of Dow Theory.

First Principle: The Stock Market Discounts All Information

The first principle of Dow Theory suggests that stock price represents sum total of hopes, fears and expectation of all participants and stock prices discounts all information that is known about stock i.e. past, current and above all stock price discounts future in advance i.e. the stock market makes tops and bottoms ahead of the economy.

It suggests stock market discounts all information be it interest rate movement, macroeconomic data, central bank decision, future earnings announcement by the company etc. The only information which stock market does not discount is natural calamities like tsunami, earthquake, cyclone etc.

Second Principle: The Stock Market Have Three Trends

Dow Theory says stock market is made up of three trends

- Primary Trend

- Secondary trend

- Minor Trend

Dow Theory says primary trend is the main trend and trader should trade in direction of this trend. It says primary trend is trader’s best friend which would never ditch trader in this volatile stock market. If primary trend is rising then trend is considered rising (bullish) else trend is considered falling (bearish). The primary trend is the largest trend lasting for more than a year.

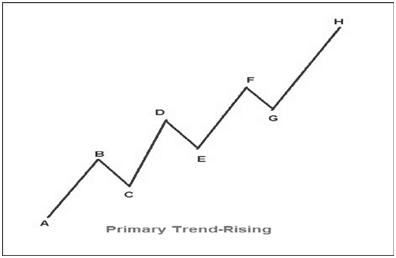

The primary trend is considered rising if each peak in the rally is higher than previous peak in the rally and each trough in the rally is higher than previous trough in the rally. In other words as long as each successive top is higher than previous top and each successive bottom is higher than previous bottom, primary trend is considered rising and we say markets are bullish. This would be clearer from (Figure 1)

(Figure 1) illustrates that each successive top that is D, F, and H are higher than previous tops and each successive bottom that is E and G are higher than previous bottoms, hence primary trend is considered rising.

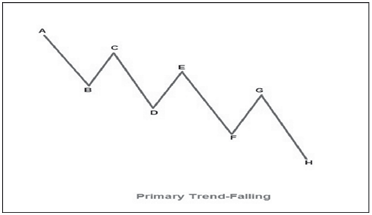

The primary trend is considered falling if each peak in the rally is lower than previous peak in the rally and each trough in the rally is lower than previous trough in the rally. In other words as long as each successive bottom is lower than previous bottom and each successive top is lower than previous top, primary trend is considered falling and we say markets are bearish. This would be clearer from (Figure 2)

(Figure 2) illustrates that each successive bottom that is D, F, and H are lower than previous bottoms and each successive top that is E and G are lower than previous tops, hence primary trend is considered falling.

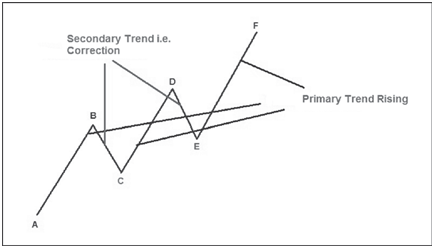

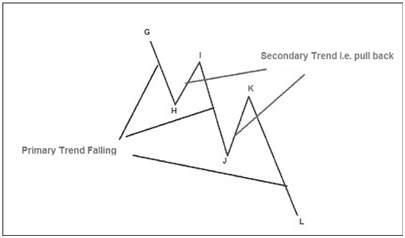

Dow Theory says secondary trends are found within the primary trend i.e. corrections when primary trend is rising and pullback when primary trend is falling. More precisely secondary trend is the move against the direction of the primary trend .The secondary trend usually lasts for three weeks to three months. This would be more clearer from (Figure 3) & (Figure 4).

Dow Theory says that secondary trend consist of short term price movements which is known as minor trends. The minor trend is generally the corrective move within a secondary trend, more precisely moves against the direction of the secondary trend. The minor trend usually lasts for one day to three weeks. The Dow Theory says minor trends are unimportant and needs no attention. If too much focus is placed on minor trends, it can lead to total loss of capital as trader gets trapped in short term market volatility.

Third Principle: Primary Trend Have Three Phases

The Dow Theory says primary trend have three phases

- Accumulation Phase

- Participation Phase

- Distribution Phase

The Dow Theory says that the accumulation phase is made up of buying by intelligent investor who thinks stock is undervalued and expects economic recovery and long term growth. During this phase environment is totally pessimistic and majority of investors are against equities and above all nobody at this time believes that market could rally from here. This is because accumulation phase comes after a significant down move in the market and everything appears at its worst. Practically this is the beginning of the new bull market.

The participation phase is characterized by improving fundamentals, rising corporate profits and improving public sentiment. More and more trader participates in the market, sending prices higher. This is the longest phase of the primary trend during which largest price movement takes place. This is the best phase for the technical trader.

The distribution phase is characterized by too much optimism, robust fundamental and above all nobody at this time believes that market could decline. The general public now feels comfortable buying more and more in the market. It is during this phase that those investors

who bought during accumulation phase begin to sell in anticipation of a decline in the market. This is time when Technical Analyst should look for reversal in the trend to initiate sell side position in the stock market.

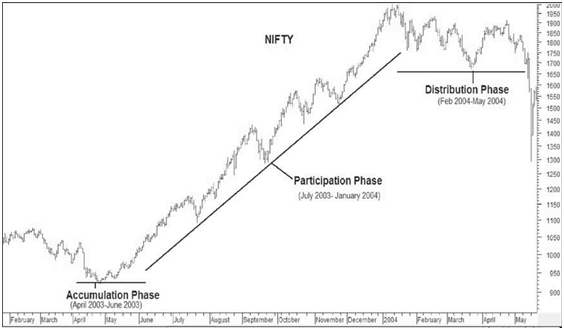

Three phases of primary trend would be clearer from (Figure 5)

(Figure 5) illustrates –

- Accumulation phase from April 2003 to June 2003 during which nobody believed that markets could rally but intelligent investor took buy side positions in the stock

- Participation phase from July 2003 to January 2004 during which largest and longest price movement

- Distribution phase from February 2004 to May 2004 during which smart money closed buy side positions in the

Fourth Principle: Stock Market Indexes Must Confirm Each Other

Charles H Dow believed that stock market as a whole reflected the overall business condition of the country. In other words stock market as a whole is a benchmark indicator to measure the economic condition of the country.

Dow first used basis of his theory to create two indexes namely (i) Dow Jones Industrial Index and (ii) Dow Jones Rail Index (now Transportation Index).Dow created these two indexes because those days U.S was a growing industrial nation and urban centers and production centers were apart. Factories have to transport their goods to urban centers by rail road. Hence these two indexes covered two major economic segments i.e. Industrial and transportation.

Dow felt these two indexes would reflect true business condition within the economy.

According to Dow

- Rise in these two indexes reflects that overall business condition of the economy is good

.The basic concept behind this is that if production is increasing then transportation of goods to customer should also increase i.e. performance of companies transporting goods to consumer should improve. According to Dow Theory, two averages should move in the same direction and rising Industrial Index is not sustainable as long as Transportation Index is not rising.

- The divergence in these two indexes is a warning

Under Dow Theory, a reversal from a bull market to bear market or vice versa is not signaled until and unless both indexes i.e. Industrial Index and Transportation Index confirm the same.

In simple wors, if one index is confirming a new primary uptrend but another index remains in a primary downtrend, then there is no clear trend.

Basically Dow Theory says that stock market will rise if business conditions are good and stock market would decline if business conditions are poor.

Fifth Principle: Volume Must Confirm the Trend

Dow Theory says that trend should be confirmed by the volume. It says volume should increase in the direction of the primary trend i.e.

- If primary trend is down then volume should increase with the market

- If primary trend is up then volume should increase with the market

Basically volume is used as a secondary indicator to confirm the price trend and once the trend is confirmed by volume, one should always remain in the direction of the trend.

Sixth Principle: Trend Remains Intact Until and Unless Clear Reversal Signals Occur

As we are dealing in stock market which is controlled by only one “M” i.e. Money and this money flows very fast across borders. Hence stock prices do not move smoothly in a single line, one day it’s up next day it might be down.

Basically Dow Theory suggests that one should never assume reversal of the trend until and unless clear reversal signals are there and one should always trade in the direction of the primary trend.

Significance of Dow Theory

It’s Dow Theory which gave birth to concept of higher top-higher bottom formations and lower top-lower bottom formations which is the basic foundation of Technical Analysis. This helps investors to improve their understanding on the market so that they could succeed in their investment/trading decisions. Most of the technical analysts follow this concept and if you go through any technical write up, you would definitely find this concept.

Problems with Dow Theory

- One misses the large gain due to conservative nature of a trend reversal signal i.e. uptrend would reverse when stock prices make lower top-lower bottom formation and downtrend would reverse when stock prices make higher top-higher bottom

- Charles Dow considered only two indexes namely Industrial and Transportation which is not major part of the economy Technology and financial services i.e. banking constitutes major part of the economy today. We have seen in 1998-1999, one sided rally in Nifty led by technology stocks. In this rally none of industrial stock participated and if one waited for buy confirmation from Industrial and Transportation indexes then one must have missed the classic bull run of technology stocks.