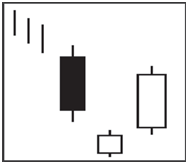

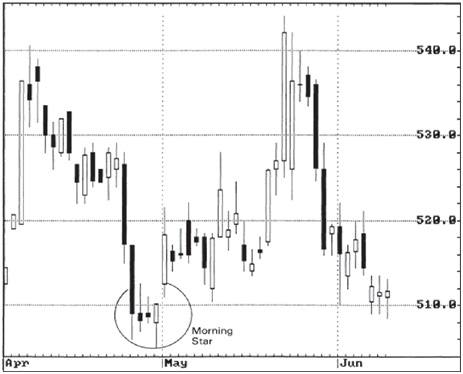

Morning star

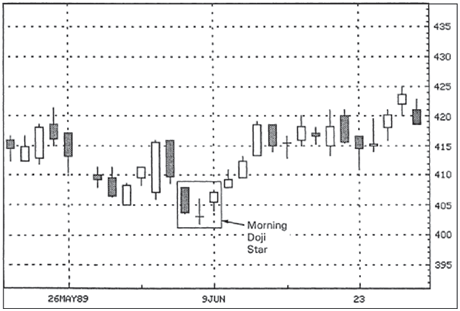

Morning star is the reverse of evening star. It is a bullish reversal pattern formed by a tall black body candle, a second candle with a small real body that gaps below the first real body to form a star, and a third white candle that closes well into the first session’s black real body. Its name indicates that it foresees higher prices.

Description

The Morning Star is a bottom reversal signal. Like the planet Mercury, the morning star, signifies brighter things – that is sunrise is about to occur, or the prices are going to go higher. A downtrend has been in place which is assisted by a long black candlestick. There is little about the downtrend continuing with this type of action. The next day prices gap lower on the open, trade within a small range and close near their open. This small body shows the beginning of indecision. The next day prices gap higher on the open and then close much higher. A significant reversal of trend has occurred.

The make up of the star, an indecision formation, can consist of a number of candle formations. The important factor is to witness the confirmation of the bulls taking over the next day. That candle should consist of a closing that is at least halfway up the black candle of two days prior.

Criteria

- Downtrend should be

- The body of the first candle is black, continuing the current trend. The second candle is an indecision

- The third day is the opposite color of the first It shows evidence that the bulls have stepped in. That candle should close at least halfway up the black candle.

Signal enhancements

- Long length of the black candle and the white candle indicates more forceful

- The more indecision that the star day illustrates, the better probabilities that a reversal will

- A Gap between the first day and the second day adds to the probability of occurrence of reversal.

- A gap before and after the star day is even more

- The magnitude, that the third day comes up into the black candle of the first day, indicates the strength of the

Pattern psychology

While a strong downtrend has been in effect, there is a large sell-off day. The selling continues and bulls continue to step in at low prices. Big volume on this day shows that the ownership has dramatically changed. The second day does not have a large trading range. The third day, the bears start to lose conviction as the bull increase their buying. When the price starts moving back into the trading range of the first day, the sellers diminish and the buyers seize control.